Create a Home Inventory

KEY POINTS

- About half of consumers have made a home inventory, according to the Insurance Information Institute.

- Apps can help you create a home inventory faster.

- “You don’t have to itemize your Tupperware,” said Lynne McChristian of the III.

Create a home inventory.

It’s one of those to-do list items personal finance journalists (me included) often recommend, yet everyone tends to put off (also me). Polls from the Insurance Information Institute estimate roughly half of homeowners have a home inventory, a rate that hasn’t budged much over time.

That’s not too surprising. Ignorance seems pretty blissful, compared with the tedious prospect of cataloging the contents of every kitchen drawer, bookshelf and stuffed closet. The good news is, creating a home inventory doesn’t need to be such a painful process. (More on that below.)

And make no mistake: it is an essential task.

Last year, natural disasters caused an estimated $330 billion in losses worldwide, according to data from Munich Re. U.S. losses account for half of that total, it found — due to hurricanes Harvey, Irma and Maria as well as severe summer and fall brushfires, and spring storms that included tornadoes and hail.

The U.S. share is bigger than usual. Long-term, U.S. losses have represented an average 32 percent of the worldwide totals, according to Munich Re.

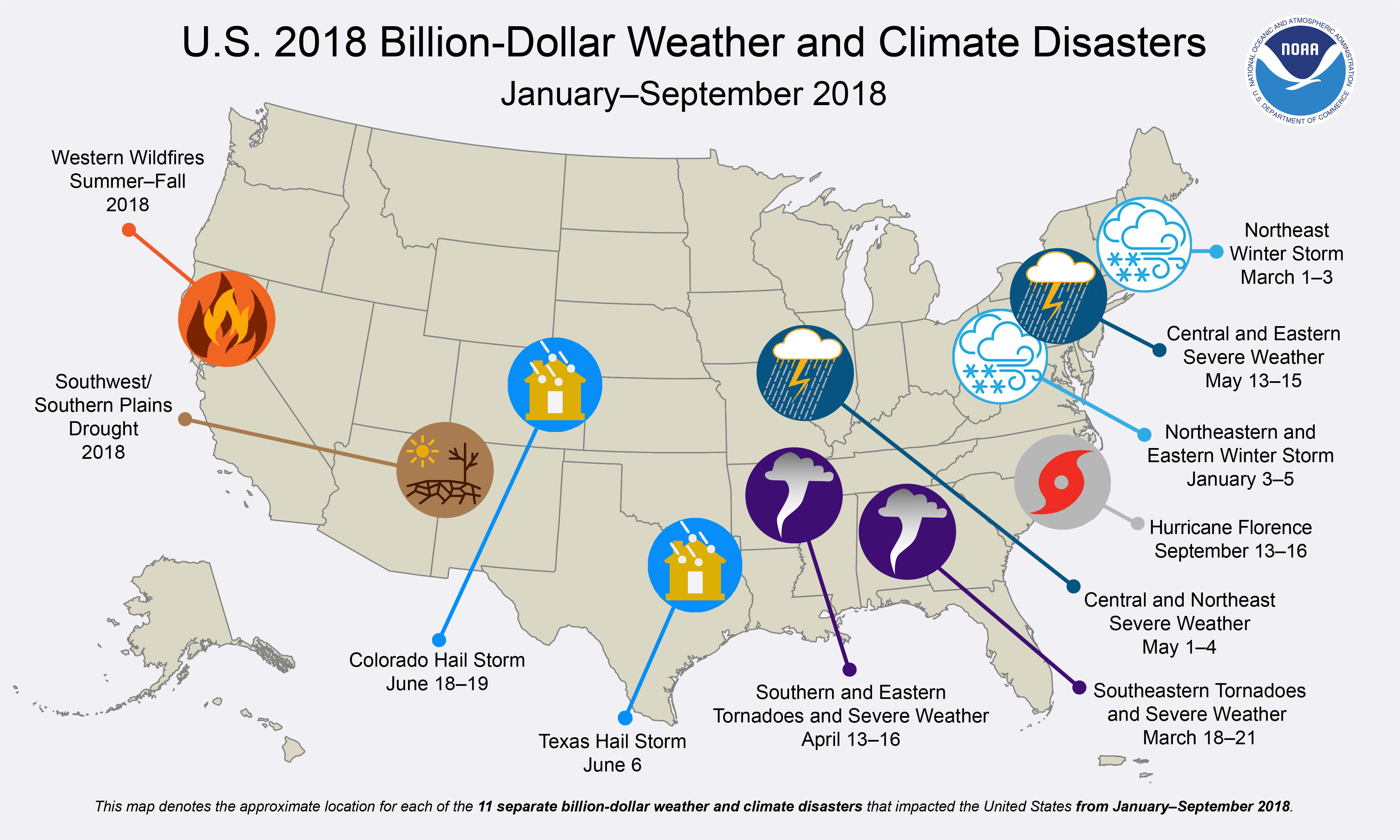

This year is on track to be another one of expensive disasters. Over the first nine months of 2018, the National Centers for Environmental Information logged 11 U.S. natural disaster events that individually racked up losses of at least $1 billion — already placing it as the fourth-worst year (behind 2017, 2011 and 2016) since tracking began in 1980.

Experts say having a good sense of what you own helps ensure you have enough and the right kind of coverage for your belongings — and should you suffer losses from disaster or theft, can make it easier to document and be fairly reimbursed for losses.

“The whole idea of insurance is to make you whole, not under-pay you or over-pay you,” said Robert Hunter, director of insurance for the Consumer Federation of America.

Valuing possessions is where that gets tricky.

As Alice Plichcik, a nurse who lost her Santa Rosa home in the Tubbs Fire last year, recently told The Wall Street Journal: “You don’t realize how much you have lost until you try to replace everything.”

Here’s how make the process of inventorying your home less painful:

1) Arm yourself with tools

There are a few different ways to lighten the home inventory load. You could outsource the task entirely, by hiring a professional home inventory company to tackle the process for you, said Hunter.

Or you could enlist an app.

I tested half a dozen home inventory apps against the contents of my kitchen junk drawer — where items as diverse as birthday candles, chip clips and the potato masher live in between uses. It seemed like a good place to start, since before this experience I’d have failed a pop quiz on its contents. (Not remembering that we own a garlic press seems like a small-change mistake, but multiply one forgotten item per drawer or shelf by 21 cabinets in the kitchen alone and well, the cost of that mis-remembering adds up.)

Two apps, I think, are worth a closer look:

- Encircle (Android, iOS; free). Inventorying can be fast going with this app. Select a room to focus on (choose one from a pre-provided list, or create your own), and then snap pictures of the space in quick succession. Once you’re done, you can go back and create individual item listings from those room photos. From there, add details to individual items as needed — there’s a field to attach notes and additional photos, as well as specific prompts including manufacturer/brand, serial number and receipt photo. You can even shop for replacements in the app to more easily get a sense of an item’s value.

- Nest Egg (iOS; $3.99, with in-app purchases). This app requires more of a time investment, but it has fields for all the right details if you have big-ticket items to document. There’s also a handy alert feature to nudge you ahead of a warranty ending or an item expiring, and to remind you about items you’ve borrowed or loaned out. (Nest Egg also has a free Lite version, which limits the number of items you can document.)

Both can be password protected (although that costs an extra $0.99 with Nest Egg), and offer the ability to keep your inventory in the cloud as well as export it as a spreadsheet.

2) Start with the big picture

Literally. A few photos or videos of each room are often enough to give insurers a good sense of what you own, Hunter said. If you can invest a little more time, snap pictures of the contents of individual drawers, closet shelves and storage bins, too.

″[An inventory] doesn’t have to be that detailed,” he said. “Insurance companies aren’t going to ask you to prove that you had eight forks instead of six.”

Or as Lynne McChristian, a spokeswoman for the Insurance Information Institute, puts it: “You don’t have to itemize your Tupperware.”

3) Add more for big-ticket items

Provide plenty of details for items that are expensive by nature (furniture, appliances, etc.), or because you’ve chosen to splurge on nicer-than-typical versions (say high-end chef’s knives, or designer clothes), said McChristian, who is also a professor of risk management at Florida State University. The same holds true for items that are antique, custom-made or otherwise unique.

With such items, it helps to have multiple pictures and other documentation like receipts and appraisals, to make sure you’re fairly compensated, she said.

It goes back to insurers not wanting to over- or under-pay you, Hunter said.

“Most insurance companies… they’re not going to try to say you didn’t have any pots,” he said — but they might quibble over the idea that you had drawers of pricey cookware, without proof.

4) Review insurance

Once you’ve logged your belongings, go back and review your insurance coverage to make sure it’s a fit. The typical homeowners policy caps coverage for contents at 50 percent to 75 percent of what you have the home insured for, said McChristian.

“Sometimes you have to say, is that enough, or do I need more?” she said.

More from Personal Finance

Pay particular attention to policy sublimits, which may have lower caps for specific categories such as electronics, jewelry, art and antiques, among others. You may want to weigh purchasing a rider or endorsement if your inventory tally shows you have belongings that collectively exceed those limits. (Once you do, you may need or want to go back and document those belongings in more detail.)

It’s also worth reviewing the terms of your coverage to make sure that your possessions will be covered for replacement value versus actual value. The difference is whether you get enough cash to buy a new couch (replacement value), versus an amount equivalent to what your five-year-old couch is worth today (actual value).

5) Maintain your logs

Once you have a working inventory, try to stay on top of new purchases, logging any new big-ticket items as you buy or receive them. Aim to review your inventory and insurance coverage at least once a year to make sure you’re still adequately protected, McChristian said.

However you create your inventory, make sure you store an up-to-date digital copy in the cloud, she said. That way, you’ll be able to access it if a disaster occurs while you’re away from home, or you can’t immediately return after a disaster.

~CNBC

Selling Your Home?

Get your home's value - our custom reports include accurate and up to date information.